You are on United States website. Change region to view location-specific content:

Global

English

Select another region

Choose region and language

- Americas

- Asia-Pacific

- Europe, Middle East and Africa

- Worldwide

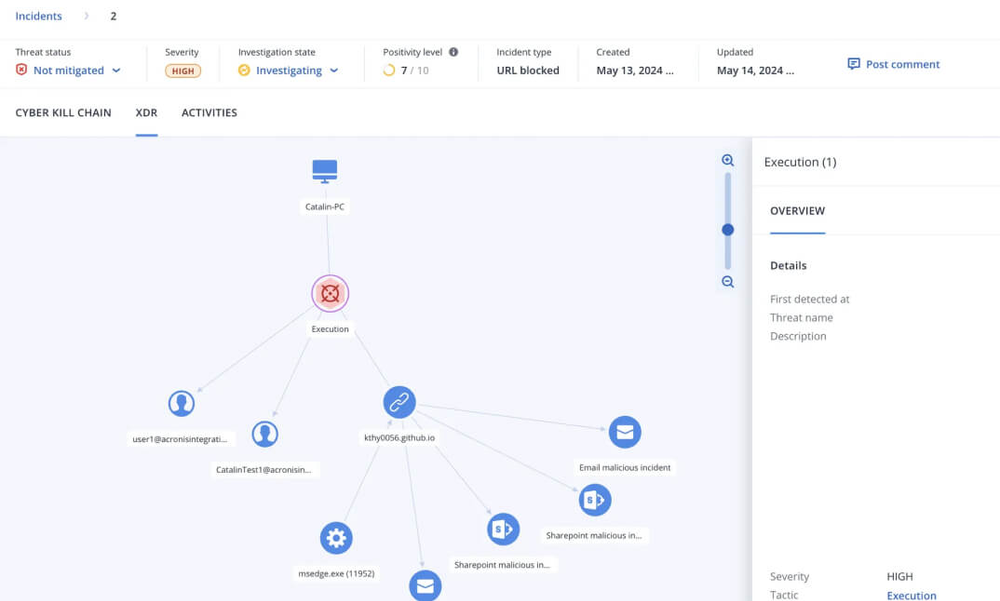

Now with XDR

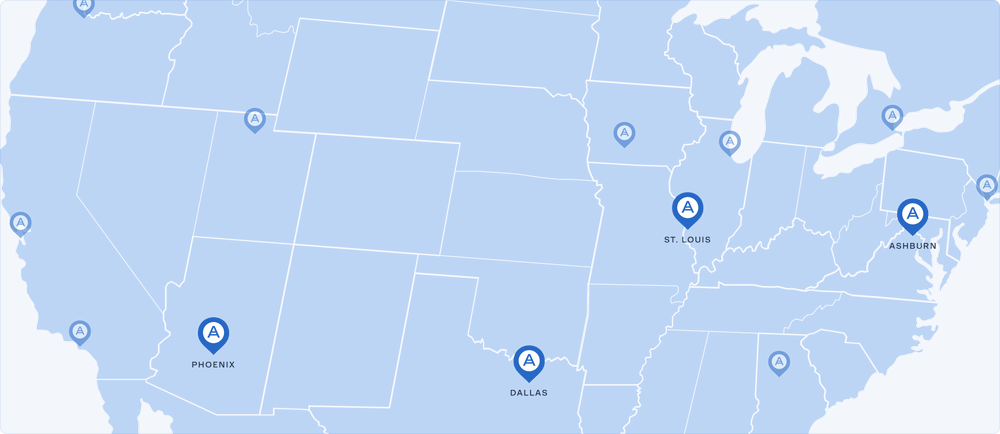

We provide robust and efficient data protection with data centers in Dallas, Ashburn, Phoenix & St Louis and over 50 DCs globally

Deploy in minutes

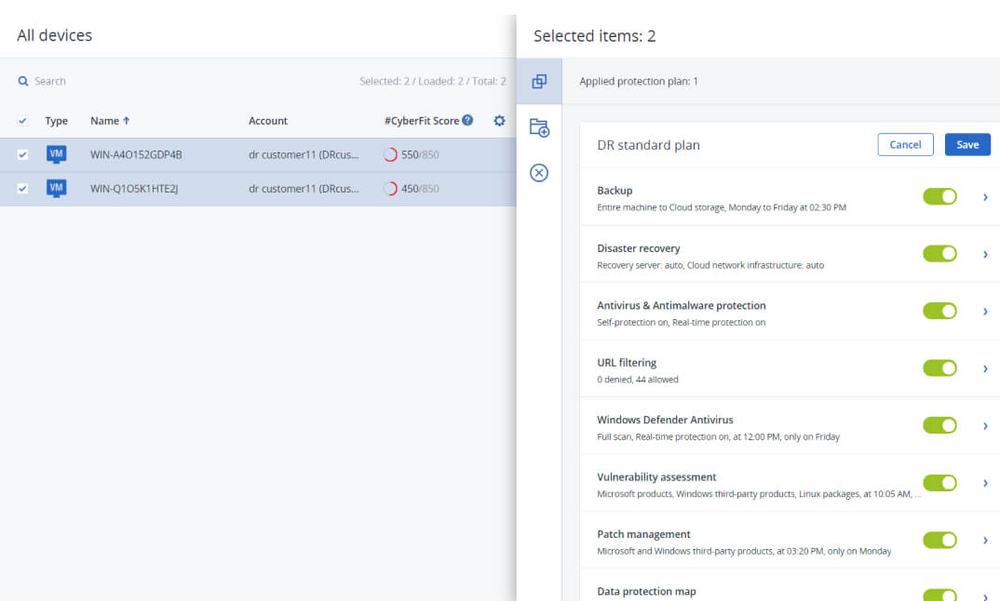

Deliver services

Acronis Ultimate 365: 7-in-1 protection for Microsoft 365

Acronis by the numbers

21,000+

Service providers

Ensuring comprehensive protection against cyber threats.

150+

Countries

Our global reach supports your success anywhere.

5,000,000+

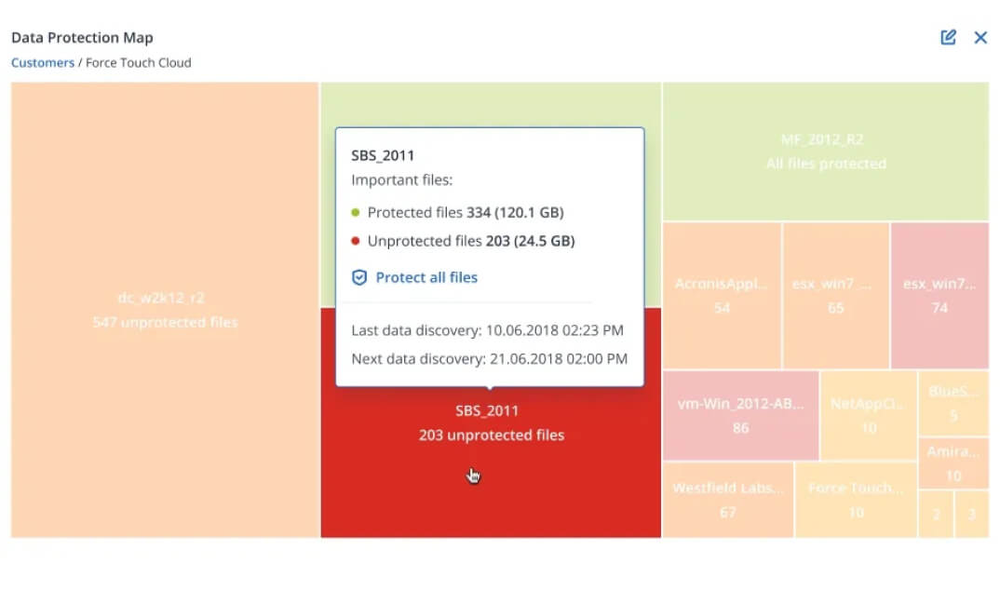

Workloads protected

We secure your critical operations.

50+

Global data centers

We provide robust and efficient data protection.

Latest on threats to managed IT service provider community

Acronis' Threat Research Unit discovered a rare in-the-wild example of a FileFix attack — a new variant of the now infamous ClickFix attack vector.

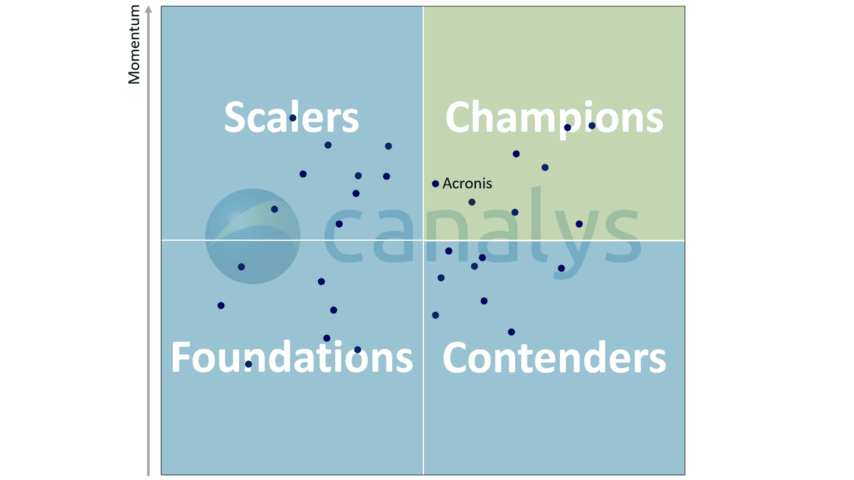

Global Canalys Cybersecurity Leadership Matrix 2025 identifies Acronis as a Champion

Canalys has named Acronis as a Champion in the Cybersecurity Leadership Matrix, citing Acronis' MSP-first approach and overall ease of doing business.

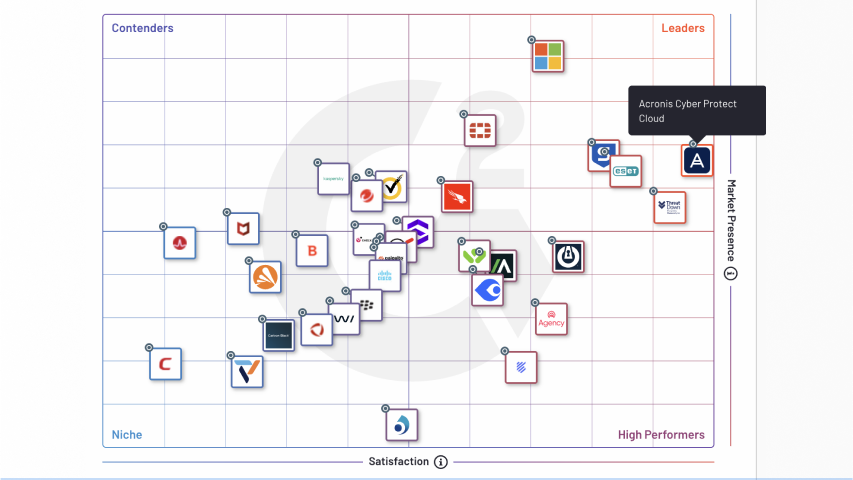

Acronis earns top placement in the G2 Spring 2025 Grid® Report for Endpoint Protection Suites

Acronis has been recognized in the G2 Spring 2025 Grid® Report for Endpoint Protection Suites, reaffirming our commitment to delivering industry-leading cyber protection.

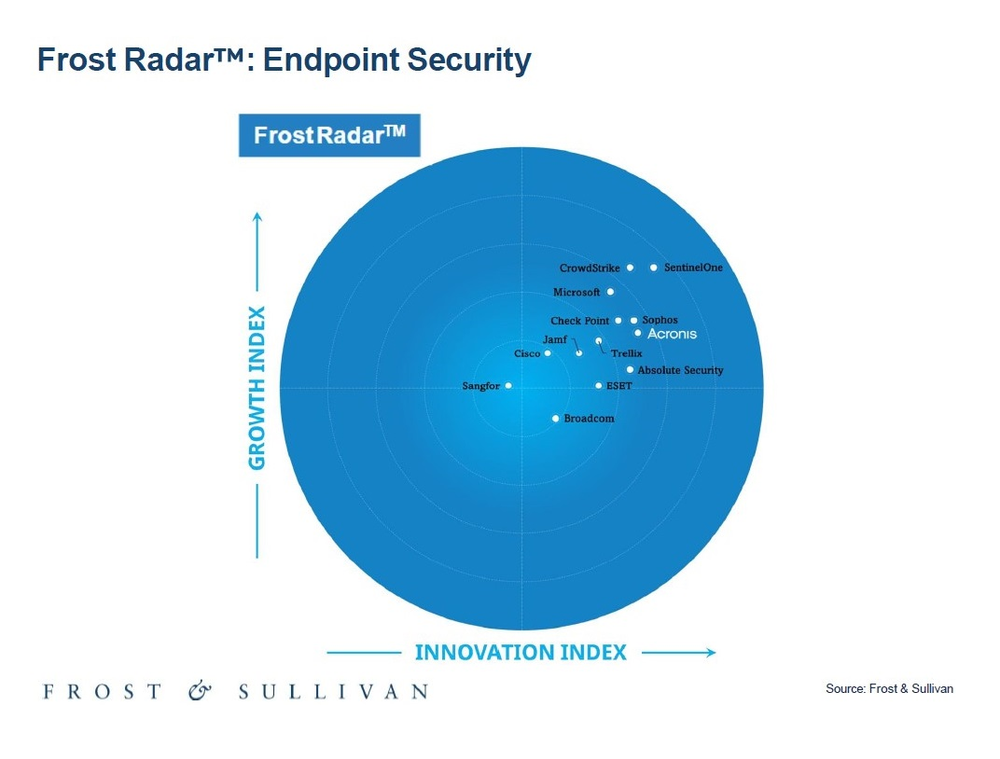

Frost & Sullivan names Acronis a Leader in its 2025 Endpoint Security Radar

The Frost Radar™: Endpoint Security report explores how Acronis is shaping the future of endpoint security and provides insights into the leading solutions in the endpoint security market.

Success journey with Acronis

Managed Service Provider training and certifications

Sorry, your browser is not supported.

It seems that our new website is incompatible with your current browser's version. Don’t worry, this is easily fixed! To view our complete website, simply update your browser now or continue anyway.