In the managed service provider (MSP) channel, Forrester tells us that about 25% of service providers are running at break-even, even during great economic times. That means that now, more than ever, it’s critical to be managing cash well. But crisis cash management is different than day-to-day management when profits are high and cash flow is steady.

The fundamentals of managing your business don’t change during a crisis regardless of what causes that crisis. Whether the cause is a natural disaster, ransomware attack, keyman illness, or a pandemic-induced recession like COVID-19, there are real, practical, and effective ways to respond to ensure the survival of your business in the short and long term.

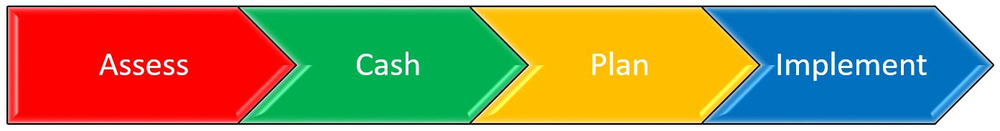

For MSPs, the process looks like this:

As long as you are willing to change and be creative when it comes to executing on solutions, you may find that you not only survive a cash crisis but thrive. You may see that there are new and different opportunities to expand or grow your business that are a result of the recession-induced crisis. And you might just find that you and your company are perfectly poised to take advantage of these opportunities in ways that no one else in your market is.

As we discussed with Forrester, this work-from-home crisis has reminded clients that working with local, skilled channel partners is a key to surviving a crisis themselves. MSPs have shown the world how agile, how responsive, and how cross-functional they are. And these skills are critical to have for go-forward projects in the area of cloud acceleration and automation. The COVID-induced recession has forced the world to transform digitally and MSPs have been – and will continue to be – at the center of that rapid transformation.

Change can be hard for many people, though, so following a simple process to manage a cash crisis can be the one thing that helps you survive and even thrive. Identify each problem, figure out the cause, decide on a solution, create metrics, execute, measure the results, and then adjust.

Phase I: Assess

The goal of the Assessment phase is to figure out where you’re at, determine how bad the situation is, why you’re there, how you got there, and define what success looks like going forward.

Determining your Capacity is key, so take a good look at your three major areas of the business: Sales, Operations, and Finance.

- Sales: What is your Market and Sales Capacity? What does your current market look like? Simply put, how much money can be made in your market delivering IT services? Are there emerging opportunities that you haven’t done before? How much of that current market opportunity can you take advantage of? Simply put, how much time do you spend selling?

- Operations: In a service business, this is your labor capacity or how much your team can handle in services sold. Utilization is a good metric to look at to see how much work your team is producing now, and how much more work they can produce during the crisis.

- Finance: What is your working capital capacity, i.e. your current assets divided by your current liabilities. This shows you whether or not you’re able to meet short-term financial obligations. Your Working Capital Capacity is a key indicator of the financial health of your business. If this KPI is skewed, you’ll find 60 ways to conserve cash in a crisis at the end of this blog.

Assessing Severity is next. List all of the undesirable effects the crisis is having on the business. For example, paused projects affect the revenue projections for subsequent quarters. What other issues could result? Look at all three areas of the business: Sales, Operations, and Finance.

Next, identify the Cause in each of the areas. You might find that if your cash position wasn’t great before the recession, you have areas to focus on regardless. In the case of the current pandemic, all IT projects have been put on hold, clients are slow paying, and some contracts have been canceled. The economic situation is entirely out of our control, but great opportunities exist that can propel and grow your business.

Finally, assess and identify the Critical Metrics you will want to track to measure results. You’ll want to identify leading and lagging metrics here so you can measure immediate results and long-term results.

Phase II: Manage Cash Flow

There are really four areas to focus on when managing cash in a crisis:

1. Spend less

2. Pay out slower

3. Sell more

4. Collect cash faster

At the end of this blog, I’ve included a list of 60 practical ways to conserve cash in a crisis.

Phase III: Plan

Figure out exactly where you can reduce costs, liquidate assets for cash, manage staff for maximum productivity, find funding, and control cash flow.

Phase IV: Implement

After identifying your plan, you move immediately to implementation. Know what success looks like by managing to your metrics every day, examining whether a metric was achieved, identifying why (or why not), and adjusting accordingly.

The key here is behavior change – something that starts with the business owners and key managers being accountable to their metrics and holding their teams accountable for their metrics. Identify each problem, figure out the cause, decide on a solution, measure the results, and then adjust.

The current recession can be an opportunity to reinvent your business. Being willing to change and being creative about how you move forward will not only help you survive but could, in fact, be the key to thriving these next few years.

60 Ways to Conserve Cash in a Crisis

Spend Less

- Keep spouses' hands out of the till

- Approval Process: approve every expense no matter how small to prevent any unnecessary costs

- Reduction in Force: layoffs are probably necessary; ensure they are well planned and work can still get done

- Business Supplies: most businesses spend twice what is needed, only buy what you need

- Supplier Discounts: you may need a discount for your business to survive; don’t be afraid to ask for discounts

- Shop: look for alternative suppliers who can deliver lower prices, better terms, and equal service

- Excess Capacity: sell it to the competition if possible…excess capacity is your most expensive cost

- Labor: use current capacity, do not purchase labor, keep your techs productive and busy

- Credit Cards: gather all cards except for the owner and enforce approval procedures

- Dues and Subscriptions: cut out all memberships and subscriptions for now

- Lease or Rent: negotiate with landlords, in many cases arrangements can be made to sublet space, reduce rent, or extend terms

- Support Services: bring everything in-house unless directly linked to billing more revenue

- Travel: unless coming back with a sale, put a moratorium on travel

- Leasing: lease all "must-have" capital expenditures, this will save you two-thirds the cost

- Pay cuts: senior management for sure, senior managers, you will lose people and lower morale, be careful here

- Training: unless an immediate increase in sales will result, do not commit any resources to training now

- Charity: only give when you can afford to

- Subcontract: work closely to reduce costs for both parties

- Trade: you probably have more time than money, trade the time for goods or services if possible

- Hardware Service Contracts: most are a waste anyway, bet your machines will keep running (like the vendor)

- Company Cars: all cars go, including the owners’, as they are a luxury that you cannot afford in a crisis

- Computers and Software: you can go at least one year without upgrading, cut this line entirely

- Legal and Accounting Services: use for taxes and compliance only until profits return

- Consultants: none allowed

- Sales Luxuries: season tickets, hunting dues, or other entertainment items must be sold

- Political Contributions: like charity, today we cannot afford this expense

- Advertising: cut all if not dealing with consumers; if retail, cut ineffective advertising

- Merge or Partner: merge or find a partner, leverage each other’s capacity and working capital

Pay Out Slower

- Adjustment of Payroll and/or Commission Cycles: weekly to bi-weekly, hold back three weeks, etc.

- Stretching: stretch payments to the fullest possible length of time

- Extended Terms: pay out in 60 days or longer, negotiate two or three types of terms

- Notes Payable: extend terms from three to five years

- Slow Pay: most banks have a 10-day grace period before you show up as past due

- Write Checks for Everything: get out of EFT/ACH of any sort and use the float it takes with checks in the mail

Sell More

- Make the Sale: If the deal has positive cash flow and you have excess capacity, then make the sale. Be careful not to cannibalize existing sales

- New Markets: move into markets you’re not currently in to grow revenues

- Price Increases: increasing prices can boost revenues and therefore cash; you need the sale though, so be careful

- Deposits: take deposits on sales as often as possible

- Terms: offer aggressive terms for quick payment

- Pre-Sell: pre-sell goods or services for the upcoming season, quarter, etc.

- Digital: increase web site traffic to generate leads, fill your sales funnel

- Up-Selling: boost transaction sizes to get more cash from the same client base

- Closing Percentage: reduce the number of touches it takes to get a sale

- Front Load: front load contracts to collect admin fees and cover hard costs

- Incentives: pay out bigger incentives to encourage additional selling

- Move Up or Down Stream: sell to different types of clients, i.e. Mid-Market or Corporate IT departments

- New Service: create new service contracts

Collect Cash Faster

- Excess Inventory: sell excess inventory to competition, consumers, eBay, etc.

- Asset Sale: sell unused or unneeded assets for fast cash

- Sell/Lease: sell assets and lease back to get cash fast

- Returns: return goods for cash or credit if not selling or will not use

- Cash and Carry: deliver products or services in exchange for cash

- COD: after deposits, collect COD to reduce the number of Accounts Receivable Days

- Collection Agencies: get fast cash on bad debt

- Judgments: seek to get paid now, be relentless

- Competitive Advantages: something all customers want that your competitors cannot or will not do

- Marketing: increase free marketing like paying for referrals

- Sales Reps: increase the number of reps moving your products

- New Product/Services: release new product/service to generate cash and size increase sales

- Lines of Credit: if in early stages, apply for a line of credit at your local bank - if you have a LOC, use it for critical working capital

About Acronis

A Swiss company founded in Singapore in 2003, Acronis has 15 offices worldwide and employees in 50+ countries. Acronis Cyber Protect Cloud is available in 26 languages in 150 countries and is used by over 21,000 service providers to protect over 750,000 businesses.