The use of gold as money began thousands of years ago – as gold was the most resistant to aging and elements. During early and high Middle Ages, Byzantine gold Solidus was de-fact standard through the Europe and Mediterranean. As Byzantine empire declined, its importance diminished together with supply of gold, and European territories adopted silver, to expand money supply and extend their economies.

Cryptocurrencies. History of Money Supply

Only in 1717 Sir Isaac Newton (the Master of Royal Mint) has established a new mint ratio between gold and silver, which led to replacing silver in circulation (British Empire had found new sources of gold in West Indies by the time).

Growing economy required larger and larger amounts of money. Moving physical gold was just too inconvenient, so first merchants and then banks started to issue paper notes as means of payment. Newfound convenience led to significant increase of money supply.

Of course, paper currency has its own problems. Electronic bank ledgers and transfer are way more convenient than paper money, that’s why cash economy in US ($1.5T) is just 4% of all liquid money on demand deposits in banks ($36.8T). We can call this 25x ratio the margin of convenience. If we apply the same 25x margin again, resulting $920T figure arrives right in the middle of the estimate for total value of financial derivative instruments, which were a revolution in financing, despite all problems they caused.

Basically, we could say that revolutionary changes in convenience increase money supply 25x. 10x would be more conservative, but still it shows that convenience of cryptocurrencies has enormous potential for growth.

But added convenience means expanded supply, so we will get 10x more money – and that sends Bitcoin value up to $4.6M, and current price of $7,500 will look ridiculously cheap. So, high expectations for cryptocurrencies are not without ground, but what is the current status?

Top 10 cryptocurrencies

- Bitcoin ($125B) Features: being the first, largest market cap ($125B), easiest to get, widest acceptance, most liquid, most proven as store value, largest dev ecosystem

- Ether ($28.3B) Features: platform for smart contracts, first alternative to Bitcoin, Vitalik Buterin

- Ripple ($7.7B) Features: strong focus on banking market, real-time settlement

- Litecoin ($2.9B) Features: most similar to Bitcoin, but could be mined effectively on PCs with GPU

- DASH ($2.1B) Features: focused on both privacy and speed of transactions, used to be called Darkcoin, uses new chained hashing algorithm, supports fully encrypted and anonymous transactions

- NEO ($1.7B) Features: “Ethereum of China”, smart contracts platform, delegated Byzantine Fault Tolerant (dBFT) instead of PoW/PoS, promises quantum computer resistance (not clear if true though)

- NEM ($1.49B) Features: wide distribution model, new proof-of-importance (POI) algorithm, integrated P2P secure and encrypted messaging system, multisignature accounts and an Eigentrust++ reputation system.

- Monero ($1.3B) Features: Strong focus on privacy and anonymity, “secure, private, and untraceable”, popular on darknet

- IOTA ($982M) Features: Scalability for IoT, m2m communication, data integrity and other mass applications, blockless (uses directed acyclic graphs), quantum-resistant, no transaction fees

- Zcash ($583M) Features: privacy-driven, all info besides timestamp is encrypted, high RAM requirements to bottleneck the generation of proofs and to make ASIC development unfeasible

Forked currencies:

- Bitcoin Cash ($9.74B) Result of Segwit fork of Bitcoin, could be claimed by all original owners of Bitcoins. Same protocol and features as original Bitcoin, the difference is increased from 1MB to 8MB block size, and more frequent difficulty adjustment. Creators claim that Bitcoin Cash is aimed at transactional market (vs pure store of value for mainstream Bitcoin) and therefore potentially has much larger capitalization

- Bitcoin Gold (N/A) Result of Segwit2x fork – replaces SHA256 hashing algorithm with Equihash, which could be mined on GPU

- Ethereum Classic ($1.33B) Ethereum Classic is an attempt at keeping the Ethereum blockchain unaltered by the part of the community that opposed the hard fork and the return of The DAO funds. It started trading on Poloniex and is getting more and more traction. In 2017, the Die Hard fork was implemented in ETC, removing the Ethereum difficulty bomb. Currently, there are no plans to move to Proof of Stake like Ethereum, although developers at the IOHK institute are developing a new PoS protocol for Ethereum Classic.

What is the difference between them?

There is over 1000 different cryptocurrencies right now. Being created as alternatives to Bitcoin, they are commonly referred to as “altcoins”. Many of these coins were created to fix some of the real or perceived problems with Bitcoin – lack of privacy, lack of speed, wasteful Proof of Work (PoW) algorithm, problems with scalability, potential vulnerability to quantum computers, high transaction fees, so on. Forked currencies were “left over” when majority decided to change something in the way of cryptocurrency functioning, and minority resisted and kept the old way or went into another direction.

We could loosely classify altcoins into following categories:

- New Platform: Ethereum, Counterparty, NEO

- New Technology: IOTA, Litecoin, NEM, Zcash

- New Application: Storj, Filecoin, Smart Media Token

- Forked: Bitcoin Cash, Bitcoin Gold, Ethereum Classic

- Minor change of parameters: many “me too” currencies using Bitcoin or altcoin as an example and changing some parameters only

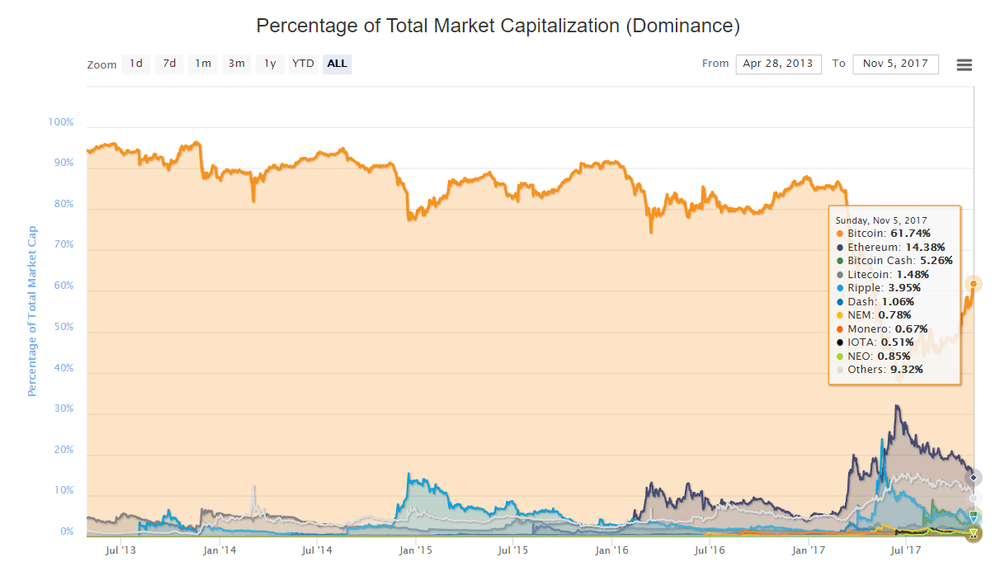

The Bitcoin is dominating the market though, with 61+% of total capitalization, and its share is growing faster than overall capitalization, indicating that:

- There is a flight from altcoins into a “safe heaven” of Bitcoin

- Despite efforts of their creators, even the most popular altcoins are used speculatively, and not to overcome Bitcoin problems

Note that this dominance gives Bitcoin a huge lead and huge mindshare. Many of its problems could be solved by overlaying Bitcoin network of nodes with another network level – to process transactions faster or to improve privacy.

Are we in a bubble?

While people are always remembering Tulip futures trading in the winter of 1636-37 as the bubble example, the term “bubble” was actually coined with the passage of the “Bubble Act” in 1720 by the British Parliament. England had recently granted the South Sea Company the right to take over its war debt in exchange for exclusive trading rights in the gold and silver rich South American colonies. Investors quickly inflated the share prices of South Sea, similar trading companies, and other “bubble” companies that the act sought to curb.

By this definition, we are definitely in a bubble.

JP Morgan CEO Jamie Dimon also criticized bitcoin by calling it a “a fraud” and stating he would fire anyone in his financial institution trading it. Later on, Dimon stated that the cryptocurrency was “worth nothing” before taking a third shot at the cryptocurrency and its investors, notably stating that anyone “stupid enough to buy [bitcoin] will pay the price.”

Ray Dalio, founder of Bridgewater Associates, the world’s largest hedge fund, also stated that bitcoin is a bubble, as it met his firm’s criteria for it, partly because some investors buy coins to later on sell them at a higher price, and because of its volatility.

Moreover, it seems like initial bubble in altcoins is already deflating into Bitcoin proper, which is perceived as “less risky”. However, it does not mean that the end is in sight or that it will be coming fast – an example of the first $1T company, PetroChina, which had its bubble burst almost 10 years ago, lost over $800B of market cap, yet it is still considered overvalued and continues to decline, defying even underlying stock market bubble in China in 2015.

There are many anecdotal pieces of evidence of a “shoeshine boy giving David S. Rockefeller stock tips” sort:

- https://www.cryptocoinsnews.com/tweet-ended-ico-bubble-debate/

- “A month before the 1987 crash, my cab driver said he started day trading,” Scott Kelly, CEO of Black Dog Venture Partners in Phoenix, Arizona told Forbes. “A month before the real estate crash in 2007 in Arizona, my cab driver said he was getting into flipping real estate. Last week, my Uber driver said he just started trading Bitcoin.”

There are scientific paper that argued as early as in 2014 that Bitcoin/USD rate shows “explosiveness” and satisfies bubble criteria:

Many altcoins have already bubbled and went out of fashion, most notably:

- Namecoin (DNS replacement), it had over $100M market cap back in 2013, went down to $2-3M by the end of 2016, but went up a bit lately to $15M raised by Bitcoin growth

- Auroracoin (deemed to be accepted as cryptocurrency of Iceland) – market cap over $1B in 2014, but it was a result of market manipulation with very low volume and liquidity. Went down to $5M (actually less than 800 Bitcoins)

In fact, many altcoins are keeping large numbers of tokens out of circulation. If we actually add the number of uncirculated tokens and multiply by current token price, total capitalization could be many times higher:

- Gnosis current circulating supply is 1,104,590, but total supply is 10M tokens (this is already issued, just kept out of circulation). At current rate around $65/GNO, their published capitalization is $72M, but if it was more accurately stated that total value of all issued tokens is $650M, it could give their “investors” a pause – how could 10 people startup without a product be worth that much?

- Ripple market cap will increase 2.5x. Historically, their full market cap would have been higher at some point than Bitcoin – all because of the large amount of uncirculated tokens

- Stellar Lumens current market cap is already huge $439M, but adjusted to full amount of tokens it will become $2.7B – enough to get into top 5 cryptocurrencies (excluding forked)

Of course, there is no rules yet that require full disclosure even on simple things like that, but sooner or later people would have to notice and the bubble will have to deflate.

On the other hand, some key speakers aren’t as dismissive of bitcoin. Goldman Sachs CEO Lloyd Blankfein recently told Bloomberg he wasn’t willing to “pooh pooh” the cryptocurrency, despite having a certain “level of discomfort with it” as is the case with anything new. Morgan Stanley CEO James Gorman also recently stated that bitcoin is “more than just a fad” that “isn’t inherently bad.”

How far will Bitcoin price go?

Here’s various well-known Money Supply amounts and corresponding Bitcoin/USD ratesif we think Bitcoin will be used to represent that amount:

Therefore, if Bitcoin is primarily used for the storage of value, like gold, then we could expect similar amount of money ($7.7T) to be represented, and one Bitcoin could be worth $300K-$400K in a long term. However, if Bitcoin (or some other cryptocurrency) would be able to displace Broad Money ($91T), then one Bitcoin or equivalent will be worth $4-5 Million. Taking it even further, by powering derivative market, we can expect prices approaching $100M.

Being totally unrelated to real world, Bitcoin naturally has negative correlation to other assets one might have in the financial portfolio. So even in current volatile state, Bitcoin and derivative instruments could be used as hedge or even safe heaven instruments to balance financial portfolio.

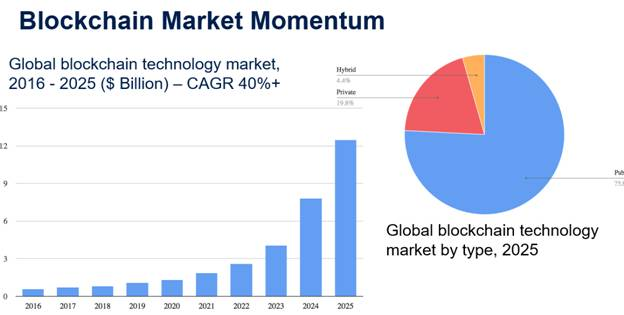

Blockchain. Market Momentum

Underlying technology of Bitcoin was decoupled and is now known as Blockchain:

CompuServe vs Internet

The best analogy for current state of Blockchain is early internet days, when Internet was just one of the networks you could use to access information: X.25, CompuServe, AOL. Eventually Internet won, because of its openness and inclusiveness, but every other company was claiming that they are open and inclusive too, while trying to lock users in with their proprietary standards and interfaces. The same is happening today with consortia and public blockchain – companies are trying to get traction in the market to lock their users in, while claiming openness and inclusiveness.

Open Internet has won, and perhaps systems that use truly open, public blockchains to provide their benefits (data unmutability, verifiability, security, privacy etc) to the users will win too.

Perhaps a new open standard will eventually emerge – but current consortium-driven blockchain development is not yet targeting such standards.

Smart Contracts

Many Blockchain implementations now include Smart Contracts as part of the platform. It allows storing computer code in the blockchain that could act on any digital assets recorded on the platform, verify that specified contractual conditions are met, and automatically perform or roll-back transactions with these digital assets.

In tomorrow’s digital world, these assets does not have to be of purely monetary nature – it could be education record and certificates, company structure and governance, or simply your portable digital identity that could be portable between banks and corporations, yet remaining private and secure.

Some Good Examples of Blockchain usage

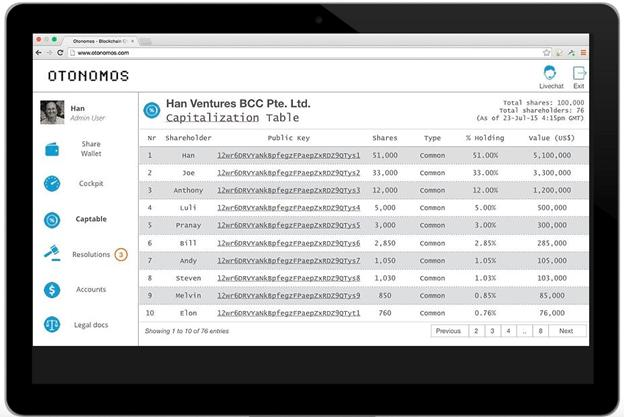

Otonomous

Otonomos is a Singaporean blockchain startup that allows entrepreneurs to incorporate their businesses on a digital distributed ledger, allowing massive disintermediation in traditional processes and reducing friction, according to Han Verstraete, co-founder of Otonomos.

Its online service enables users to form, fund and govern their companies on the blockchain using Smart Contracts, bringing company incorporation and governance to the digital era.

ShoCard

ShoCard is an identity management system (IMS) built using the blockchain for the highest level of security, and uses public/private key encryption and data hashing to safely store ad exchange data. Through the ShoCard application, a person’s identity and data are stored on their device and they are the only person who determines which ID details are shared. ShoCard uses the blockchain as a public, immutable ledger that allows third parties to validate that the original data or certification has not been changed or misrepresented. ShoCard’s groundbreaking technology is optimized for the enterprise with ShoBadge.

Blockchain Technology Overview

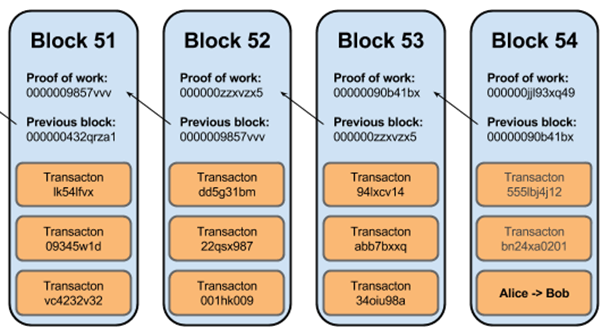

First, there was a Bitcoin, based on a Blockchain technology from now famous Satoshi Nakamoto paper in 2009. Blockchain is a shared decentralized public ledger, where information is stored in blocks. Each block contains:

- a set of valid transactions,

- timestamp and

- link to a previous block

That is why it is called Blockchain

- Whenever any data needs to be recorded on blockchain, it is broadcasted to all nodes running full software stack – there is no central authority

- Nodes keep full copy of blockchain, which is open to the public to read. Private data recorded on blockchain is usually encrypted by owner.

- Nodes verify each data transaction and organize them into blocks together with mathematical proof that enables trust. Blocks are linked together in a manner that makes tampering with old blocks progressively and massively expensive.

- Security of your transaction relies on public key encryption. This implies requirements for private key security, which is extremely hard to achieve while providing good user experience. For example, even the inventor of most popular public key crypto solution, PGP, Phil Zimmerman, can’t read PGP-encrypted email, as evidenced by this tweet:

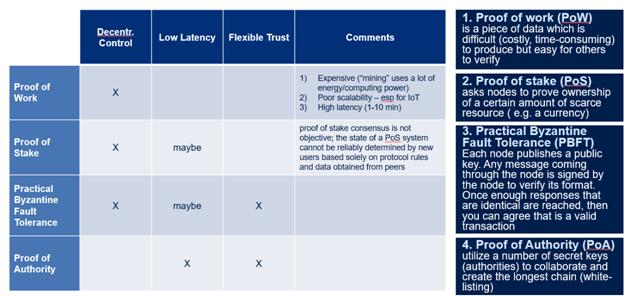

- Transactions are validated by a consensus of the nodes. Choice of consensus algorithm has major implications on performance, scalability, latency and other Blockchain parameters

Facts about Bitcoin blockchain:

- 10,640 bitcoin nodes running full software: 31% in US, 16% in Germany, 6% in France

- 491,810 blocks – new block every 10 minutes, 145GB in total – was 70GB in Jan 2017

- A block could only be added if more than 51% of nodes validates it

- Each block includes the hash of the previous one, so tampering with the block requires re-computing of all subsequent blocks – prohibitively expensive

- Top 4 mining pools are all in China, and collectively represent 70% of computing power

- Combined mining power: 10+ exahashes/sec, requiring 100,000 tons of hardware (enough to build 10 Eiffel towers), uses 2.5+ GW of electricity (enough for 2M households – same as in Slovakia)

- By 2020, Bitcoin could use as much electricity as whole country of Denmark

Bitcoin implementation spawned a lot of altcoins, and soon enough people have started thinking beyond just cryptocurrency or P2P money transfers, toward universal digital value transfer.

Colored Coins started as a simple idea of recording metadata about such transaction on blockchain, Ethereum went much further and built a Smart Contract platform, while using their own Blockchain implementation with more scalability and lower latency.

Banks and financial institutions liked the idea of distributed ledger, and they have built their own federated or fully private blockchain implementations, restricted to the member of consortium. Largest and most widely known such consortium, R3, after studying blockchain applicability decided to build their own distributed database platform, R3 Corda. Its descriptions specifically says, “Although it is inspired by blockchain databases, and is expected to have many of the benefits of blockchain, it is not a blockchain.”

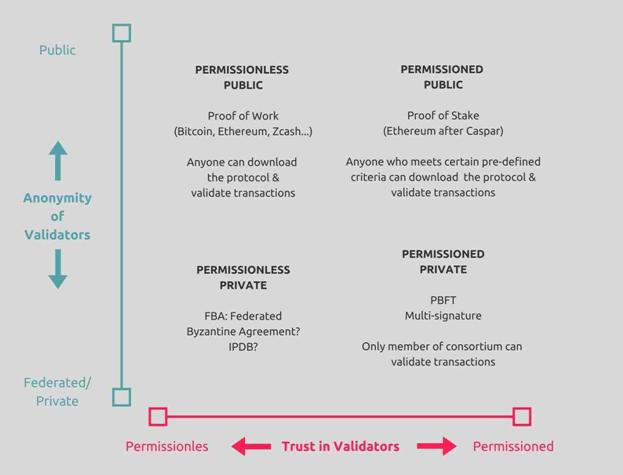

Public, Consortium and Private Blockchains

- A public blockchain is a blockchain that anyone in the world can read, anyone in the world can send transactions to and expect to see them included if they are valid, and anyone in the world can participate in the consensus process – the process for determining what blocks get added to the chain and what the current state is.

- A consortium blockchain is a blockchain where the consensus process is controlled by a pre-selected set of nodes; for example, one might imagine a consortium of 15 financial institutions, each of which operates a node and of which 10 must sign every block in order for the block to be valid.

- A fully private blockchain is a blockchain where write permissions are kept centralized to one organization. Read permissions may be public or restricted to an arbitrary extent. Likely applications include database management, auditing, etc internal to a single company, and so public readability may not be necessary in many cases at all, though in other cases public auditability is desired.

Types of Blockchain

There were attempts to classify blockchains on many parameters:

More info:

- https://blockchainhub.net/blockchains-and-distributed-ledger-technologies-in-general/

- On Public and Private Blockchains, Vitalik Buterin (2015)

- Vitalik Buterin: On Public and Private Blockchains, Coindesk

- Ok, I need a blockchain, but which one?, Pavel Kravchenko

- IBM blockchain explained, Diego Alberto Tamayo

What are the problems?

- Blockchain in theory is supposed to solve people problems: lack of trust, reaching agreement on some contract. Yet in practice people problems are not solved – we are getting technological solution to technical problems, all that algorithms do is deciding who gets to write the next block in the blockchain.

- Theoretical Blockchain use cases take place in purely digital world, alternative system. There is no roadmap to transition in that pure digital world and in practice Blockchain does not transform our current system, it simply complements it

- Recognized use cases for Blockchain (property title registry, supply chain provenance, insurance claims) are great in theory but do not solve actual problem: lack of properly cleaned and 100% correct data. People lie or information does not get entered into the blockchain properly or at all – this is a real problem and it is not getting solved by Blockchain any better than standard database.

- Blockchain without “natural” incentives to participate is just another database

- Smart Contracts, unlike legal contracts, do not capture intent (which is fundamental rule of the legal system) – these are pieces of code that are being executed literally. If challenged in court, result of the execution might need to be reversed anyway.

- Blockchain promise of decentralization comes at a great loss of efficiency. Re-centralization makes the process much more efficient immediately and typically makes business sense

- The only long lasting and proven use case for decentralized applications so far is Bitcoin

- User Experience of all Blockchain apps is generally dismal – that’s probably why nobody actually uses 700+ dApps (decentralized apps for Ethereum) listed on https://www.stateofthedapps.com

Other ways to solve the problems

- 1st Generation: Bitcoin Blockchain: Shared Ledger

- 2st Generation: Ethereum Blockchain and Smart Contracts

- 3st Generation: No Blockchain? Byzantine Fault Tolerance without PoW/PoS

Examples:

- Byteball

- Swirlds Hashgraph

- IOTA-token

Use Directed Acyclic Graphs and avoid PoW/PoS consensus

- Much higher performance – 100,000s transactions per seconds executed directly

- Much less space required – no need to store Blockchain copies, requirement for IoT

- Ordering and fairness of transactions – this enables new kind of applications, such as stock exchanges or auctions, ensures fair contract execution

- No fixed block size

- No Proof of Work = Efficient

- Could be made Quantum-safe

What is Hashgraph?

- A "hashgraph" is a data structure, storing a certain type of information, and updated according to a “gossip about gossip” algorithm. The data structure is a directed acyclic graph, where each vertex contains the hash of its two parent vertices.

- The stored information is a history of how everyone has gossiped. When Alice tells Bob everything she knows, during a gossip synch, Bob commemorates that occurrence by creating a new "event", which is vertex in the graph, containing the hash of his most recent event, and the hash of Alice's most recent event. It also contains a timestamp, and any new transactions that Bob wants to create at that moment. Bob digitally signs this event. The "hashgraph" is simply the set of all known events.

- The hashgraph is updated by gossip: each member repeatedly chooses another member at random, and gives them all the events that they don't yet know. As the local copy of the hashgraph grows, the member runs the algorithm r to determine the consensus order for the events (and the consensus timestamps). That determines the order of the transactions, so they can be applied to the state.

More info:

- https://satoshiwatch.com/coins/iota/in-depth/iota-dag-tangle/

- https://coinidol.com/is-dag-better-than-bitcoin-blockchain/

- https://due.com/blog/five-blockchain-technologies-watching/

- https://eprint.iacr.org/2016/871.pdf (Blockchain-Free Cryptocurrencies: A Framework for Truly Decentralized Fast Transactions)

ICO. Overview

ICO is a way for start-ups to raise money by issuing a new cryptocoin, while users pay them bitcoin or ethereum. It's similar to crowdfunding but with digital money.

The first crypto-token sale (also known as an ICO) was held by Mastercoin in July 2013. Ethereum raised money with a token sale in 2014, raising 3,700 BTC in its first 12 hours, equal to approximately $2.3 million dollars. Another ICO was held by Karmacoin in April 2014 for its Karmashares project.

ICOs and token sales are now extremely popular. At the start of October 2017, ICO coin sales worth $2.3 billion had been conducted during the year, more than ten times as much as in all of 2016.

On September 4th 2017 China banned all ICOs and the Central Bank of China listed 60 exchanges involved in listing and trading ICO related tokens that would be inspected by the financial regulators. South Korea was the next country to severely restrict ICOs on September 29th 2017.

The first regulated market for ICOs was created in September 2017 by the Gibraltar Stock Exchange. This would be covered by Gibraltar DLT regulation. Utility tokens will be traded in the newly created Gibraltar Blockchain Exchange (GBX), while security or equity tokens will trade in the traditional stock market.

ICO as an investment instrument

While right now ICO are a simple crowdfunding instrument, it has a huge potential as a sophisticated investment instrument due to the power of Smart Contracts. When used properly, ICO allows investing in shares, products, and other derivatives of business functioning, not just in equity, like traditional instruments. Revenue sharing is a simplest example. Smart Contracts could provide guarantee of payments even if the business is dead, but its products are still being sold.

Of course, to be useful, there should be regulations, investment protection and mechanisms of enforcement. Early stock markets were also unregulated and dangerous, the SEC itself was only created in 1934, in the wake of Great Depression, which was one of the classic bubble examples, caused in large part by the lack of enforcement of existing government laws and regulations (e.g. Blue Sky Laws, term is said to have originated in the early 1900s when a Supreme Court justice declared his desire to protect investors from speculative ventures that had "as much value as a patch of blue sky.") To put things in perspective, NYSE was founded in 1817 – so market was unregulated over 100 years, and it took Great Depression to change the situation.

So, of course, regulating this new investment instrument is not going to be simple, but the potential benefits of such instrument are too great to dismiss. Just like IPO is a better instrument than traditional private equity investment, because it is a standard and safe way to exchange money for equity rights, ICO could become standard and safe way to exchange money for all value associated with the company – be it production stock, future cash flow, or other derivatives.

Best ICO

- Filecoin – $250 Million

Filecoin is blockchain data storage network that launched on August 10, 2017. Filecoin will use peer-to-peer InterPlanetary File System, or IPFS, to store and secure data, which will allow users to earn by donating their free hard drive storage space. Its only competition will be MaidSafe, another decentralized storage project. Filecoin raised $200 million from accredited investors and another $52 from venture capital firms. As of August 21, over $250 million in funds had been raised.

- Tezos – $232 Million

Tezos is a new a blockchain that fixes the governance issues that blockchains like bitcoin face. Instead of relying on off-chain debates, compromises and consensus to improve, scale or change the core software, Tezos has self-governance mechanism built into the protocol.The Tezos ICO launched on July 1. At the end of the 14-days sale period, the project had raised about $222 million in bitcoin and ether. That became the new ICO record.

- EOS – $183 Million

Block.one is a start-up building a blockchain that meets the specific needs of the businesses and companies in the corporate world. It plans to provide blockchain solutions that offer efficiency, security and data integrity. The start-up carried out its ICO in June to support the project development. Its EOS tokens raised $183 million. That held the record until Tezos overtook it three weeks later.

- Bancor – $153 Million

As more cryptocurrencies and tokens get into the crypto market, the need to transact and move value from one to another is growing. While current cryptocurrency and token exchanges facilitate the process, their centralized nature expose users to insecurity and don’t support all the tokens out there. Bancor seeks to build a decentralized exchange ecosystem that will enable holders of digital assets to trade peer-to-peer with ease and with little risk to the security of their assets. It will also support any token that is issued regardless of the number of users. Its June ICO raised $153 million.

- Status – $108 Million

Status is a browser, wallet and a messenger app. It is also a gateway to decentralized applications that are built on top of Ethereum. The Status app will be available for mobile to enable on-the-go use. The team behind Status held an ICO on June 20th and raise $95 million. With more start-ups choosing ICO and the public’s interest growing, at least some of the ICOs in this list might end up not being in the top five of the biggest ICOs in 2017. Even companies that have had little to do with blockchain until recently are now interested in ICO. For instance, the messaging App Kik has released a whitepaper explaining its plan to hold an ICO.

Yes, there are problems with ICO

- Unregulated market – what rights does the owner of token really have? No track record of post-ICO investments – valuation is unclear, for one Many startups are raising crypto-currency from crypto-investors who have no experience (extremely dumb money) only because more professional investors would not fund them While ICO is being sold to public as crowdfunding, few existing professional investors on this market treat them purely speculatively. Typically they will just buy tokens with discount in a closed round and then dump them with a profit as soon as possible to the general public (few months investment horizon) Total $200B crypto market is a drop in a bucket in $70T+ global stock market. While Bitcoin returns of 5x-10x are great, this is standard return expected from successful startup by normal VC, and success rate of crypto-startups would probably be lower, as too many of them are raising money on pure idea stage ICO costs are growing very fast, both because of greed and Bitcoin valuation growth. September ICOs had costs around $500K, October ICOs are expected to cost in a range of $750K- $1M. September ICOs were largely not very successful – only around 7 companies had shown any growth post-ICO out of 100+ (only one is notable – NEO), October is even worse – only two (DOVU - and ALIS) are growing yet, and they are small and not beating any records There is no transparency in the ICO world – information on past performance is not easily obtainable. The only site that provides comparison of historical returns has very limited number of token covered - https://icostats.com/roi-since-ico Diminishing return will probably cause remaining professional investors to retreat soon, killing whatever little liquidity is in the market

Are all ICOs scams?

- Tim Draper is one of the sharpest VCs in the entire cryptocurrency space. He bought the entire second auction of Bitcoins offered by the US Marshals as part of the Silk Road asset seizure, and he is participating in the ICO of Tezos

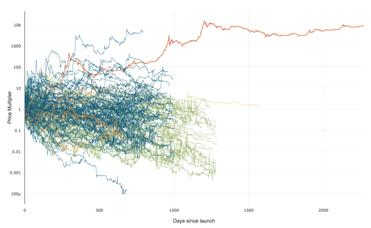

- 99% of early stage startups will naturally fail. ICOs participants are from the same pool, often with the distinction of not being able to get traditional funding. Here’s a chart showing downward trajectories of 500+ crypto-tokens. Bitcoin is red, clearly majority of other goes down early

- ICO funds could be stolen due to various security oversights – it is not a scam, but perhaps a consequence of novelty and lack of proper regulation. Major example of such heist was the story of DAO, where smart contract allowed “recursive call” attack that led to $60M being stolen and subsequently required hard fork of Ethereum (rewinding all transactions as-before) to return the money. Once ICO will become safer and better regulated, they could become a great investment instrument in a world that turns to be increasingly digital and powered by digital assets. Small Business is hungry for money and safe and standard way of investing into it could fuel potential order of magnitude growth in SMB financing.

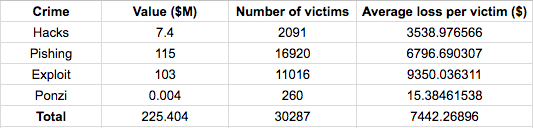

- According to research firm ChainAnalysis, $225M was stolen from over 30,000 victims in ICO by Aug 2017:

About Acronis

A Swiss company founded in Singapore in 2003, Acronis has 15 offices worldwide and employees in 50+ countries. Acronis Cyber Protect Cloud is available in 26 languages in 150 countries and is used by over 21,000 service providers to protect over 750,000 businesses.