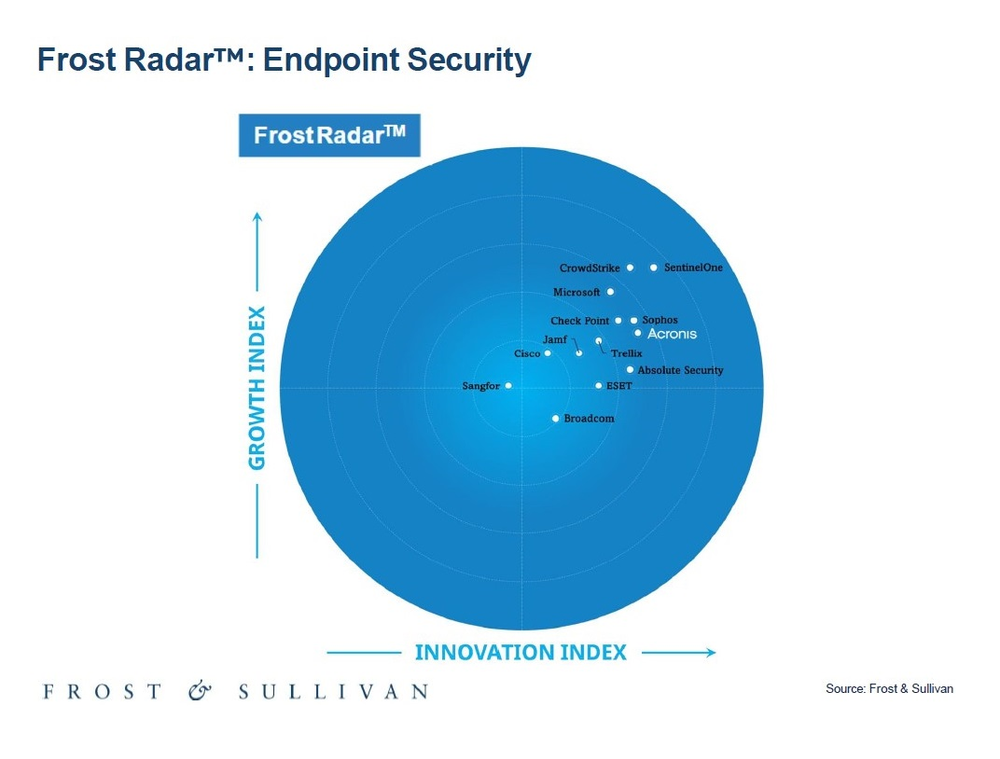

Natively integrated cyber protection

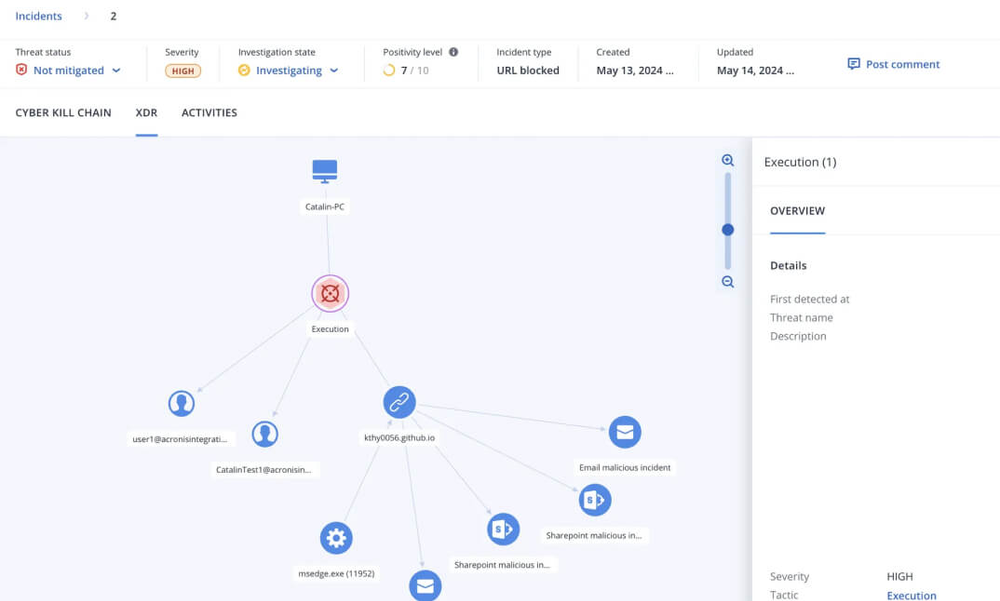

Now with Security + XDR

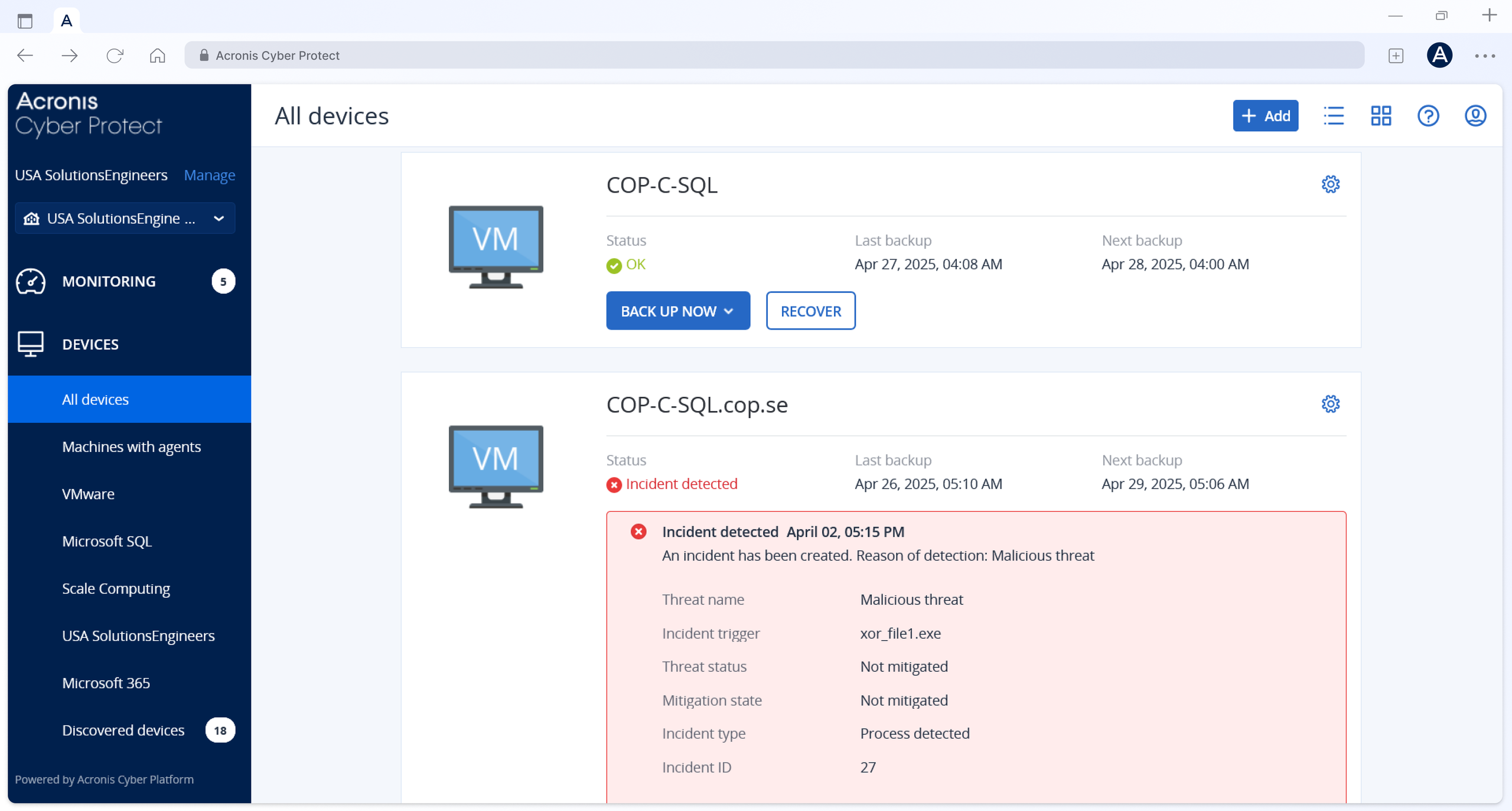

Detection and Response

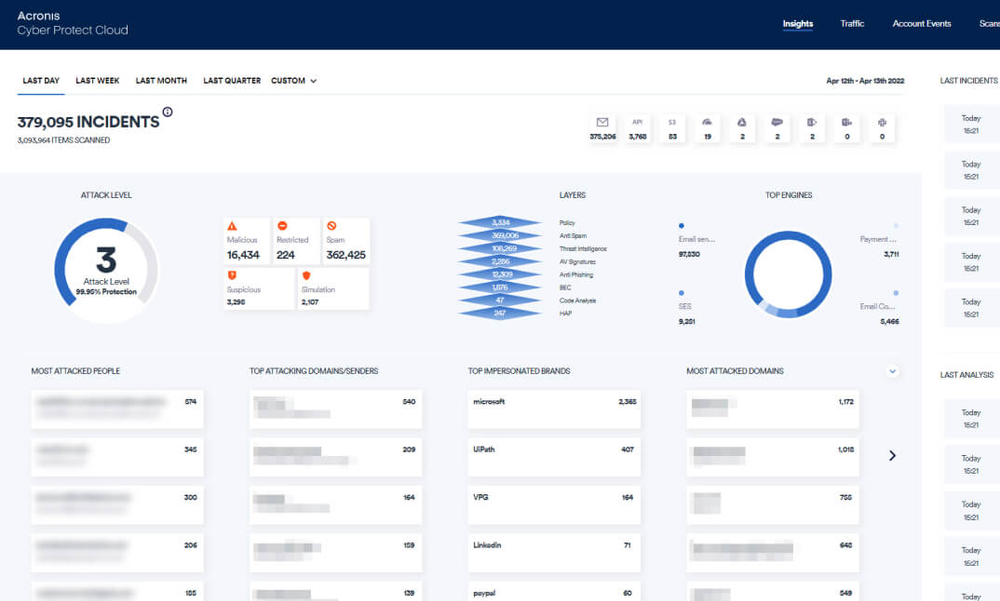

SaaS Security

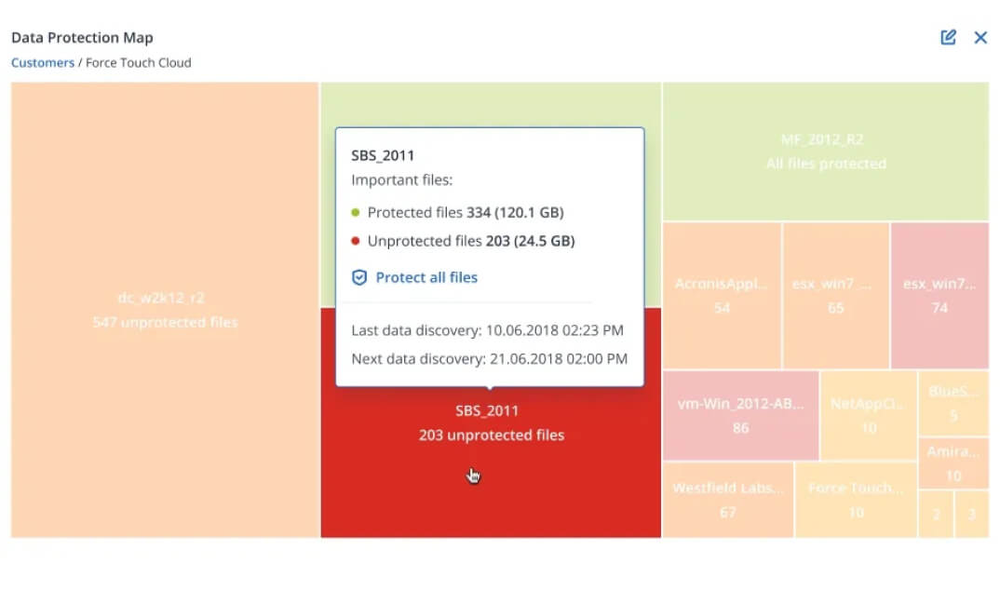

Backup

Disaster Recovery

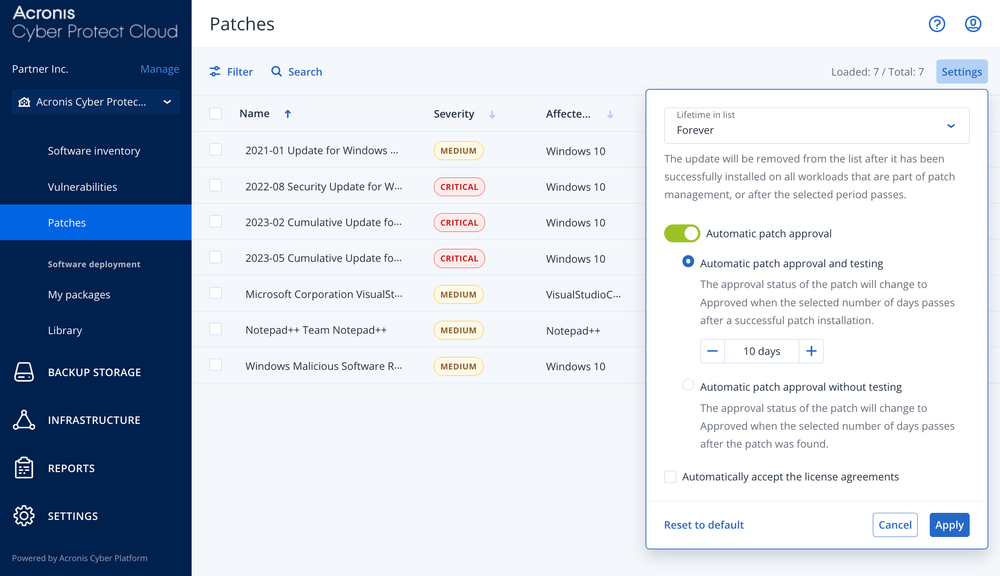

RMM

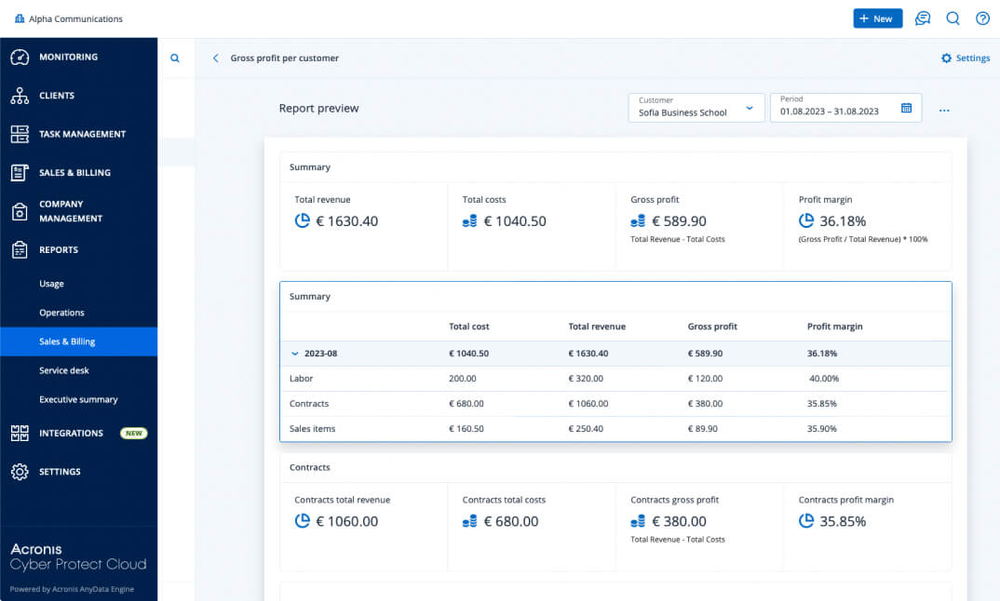

PSA

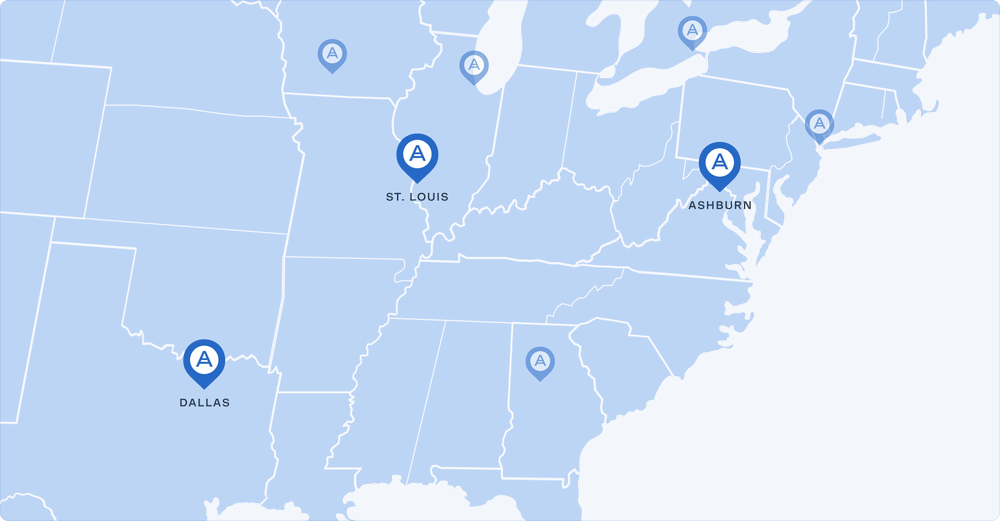

Acronis in United States

We provide robust and efficient data protection with data centers in Dallas, Ashburn, Phoenix & St Louis and over 50 DCs globally

ISO/IEC 27000 series, NIST, HIPAA and others

Offices in Burlington & Tempe

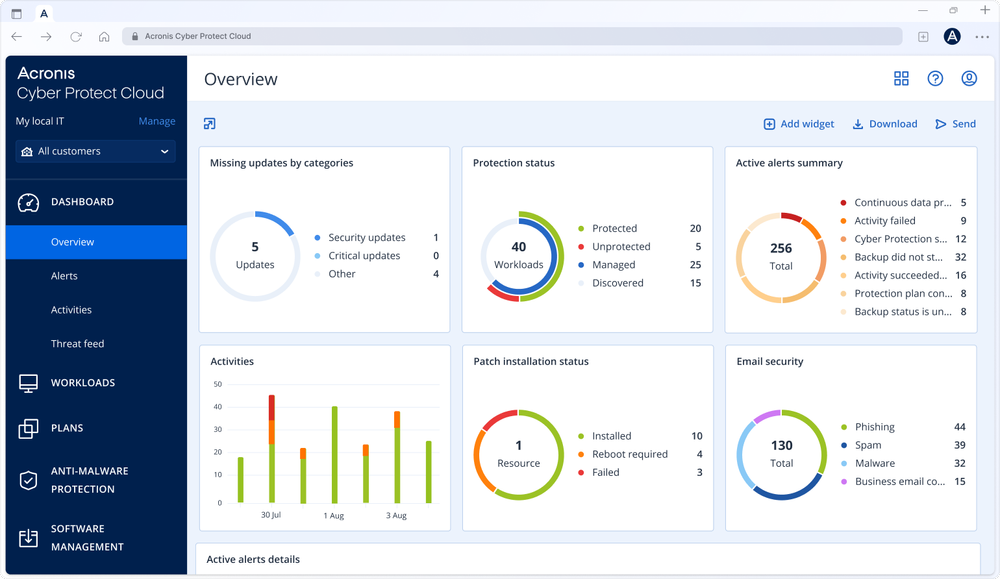

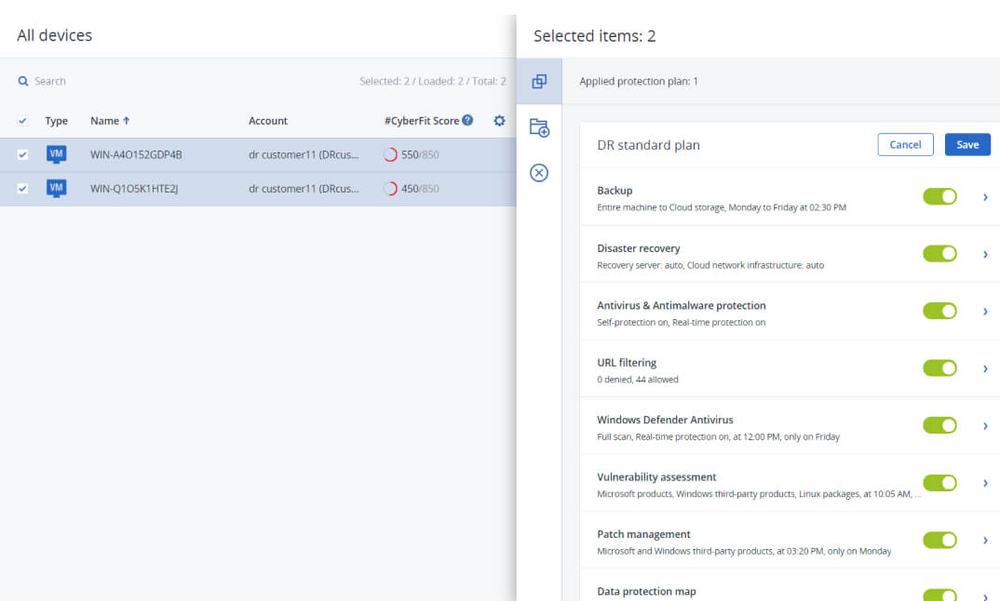

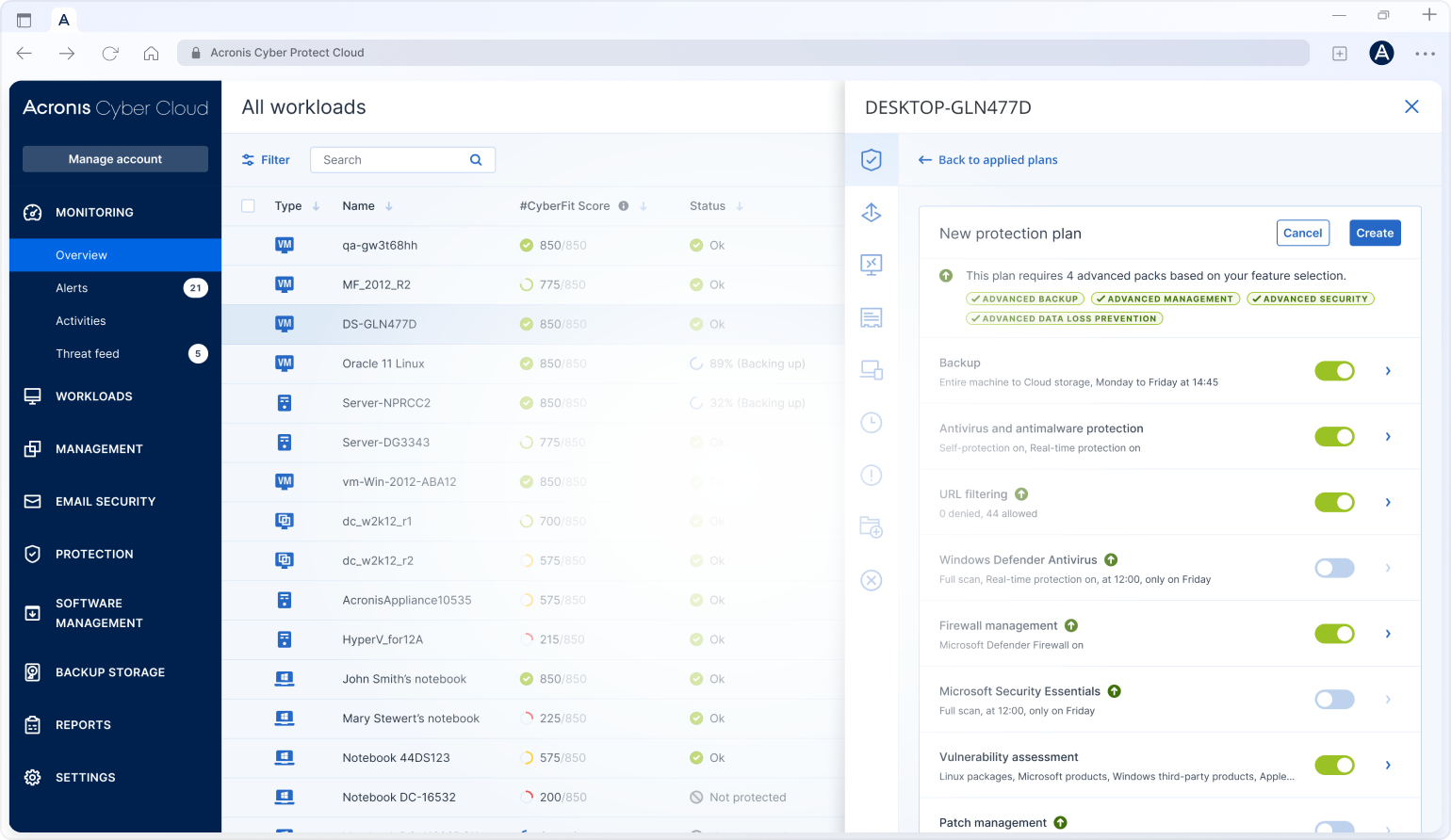

Build and scale a robust security service from a single platform

Deploy in minutes

Deliver services

Grow With Acronis

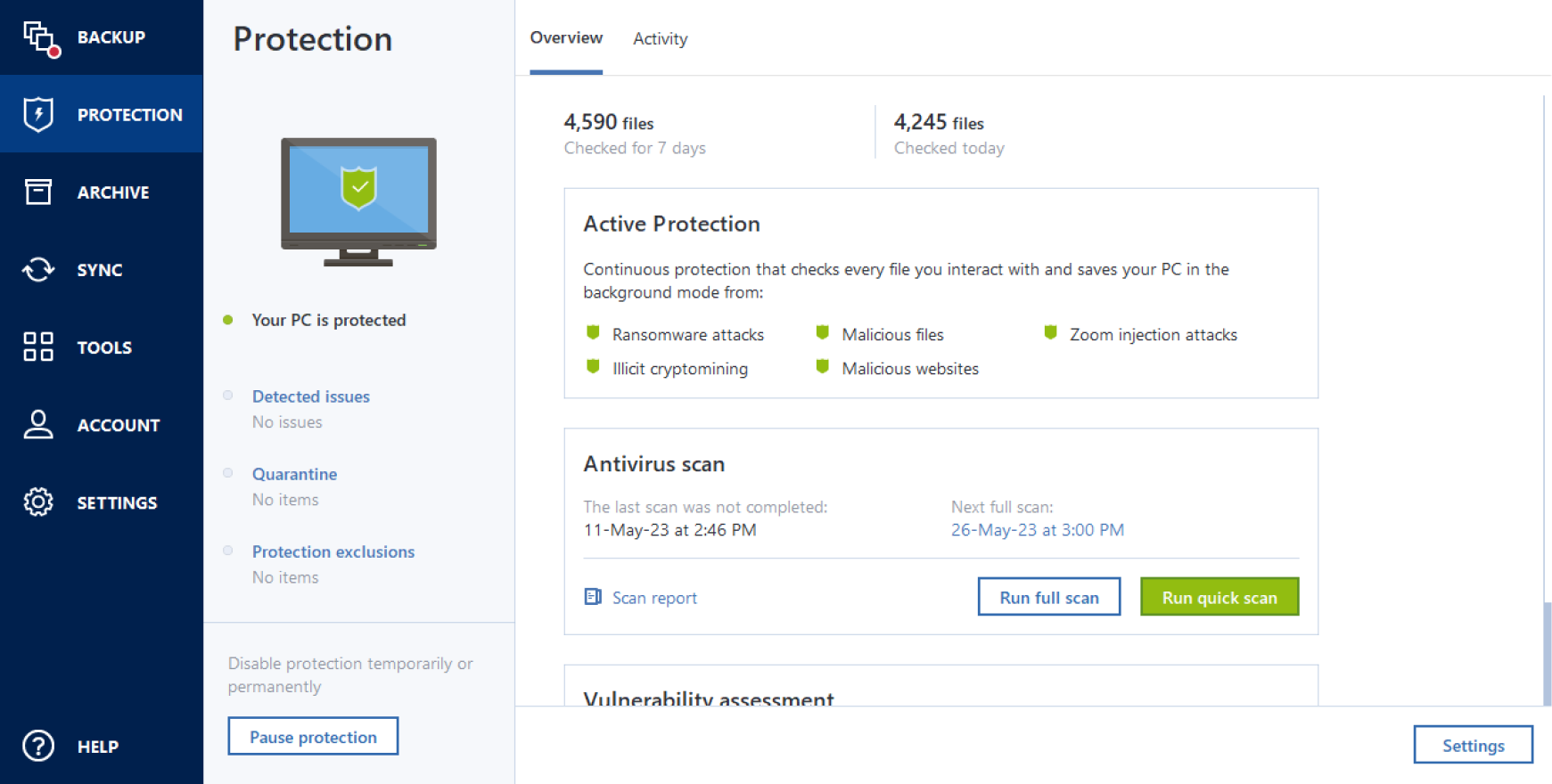

Consolidate your security stack into one platform

300 integrations with the MSP tools you trust

300 integrations with the MSP tools you trust

Acronis Ultimate 365: 7-in-1 protection for Microsoft 365

Acronis by the numbers

21,000+

Service providers

Ensuring comprehensive protection against cyber threats.

150+

Countries

Our global reach supports your success anywhere.

5,000,000+

Workloads protected

We secure your critical operations.

50+

Global data centers

We provide robust and efficient data protection.

Latest on threats to managed IT service provider community

Hunters International, a well-known threat group known for their ransomware-as-a-service operations, has started using new RAT malware. The first incident featuring this software was spotted at the start of August 2024 and was named SharpRhino due to its C# language.

Success journey with Acronis

Sorry, your browser is not supported.

It seems that our new website is incompatible with your current browser's version. Don’t worry, this is easily fixed! To view our complete website, simply update your browser now or continue anyway.